Purchasing a home represents one of the most significant financial decisions most people will make in their lifetime. With more than half (51%) of Americans planning to buy a home in 2025, it’s crucial to approach this process with thorough preparation and careful consideration. The current market presents unique challenges, as 40% of respondents revealed that buyers found the home buying process to be more challenging than they had initially anticipated. Understanding what to look for when buying a new house can help you navigate this complex process successfully and avoid costly mistakes.

Financial Readiness and Pre-Approval

Before falling in love with a particular property, establishing your financial foundation is paramount. This begins with obtaining mortgage pre-approval, which demonstrates to sellers that you’re a serious buyer and gives you a clear understanding of your budget limitations. Your financial readiness should encompass not just the down payment, but also closing costs, moving expenses, and potential repairs or improvements.

Consider your debt-to-income ratio, credit score, and employment stability as these factors significantly impact your mortgage terms and interest rates. Mortgage rates could dip by about 0.19 percentage points by the end of 2025, making it important to stay informed about market trends while remaining flexible with your timeline. Create a comprehensive budget that accounts for property taxes, homeowners insurance, and ongoing maintenance costs to ensure long-term affordability.

Location and Neighborhood Assessment

The age-old real estate adage about location remains as relevant today as ever. When evaluating a potential neighborhood, research local schools, crime statistics, and future development plans that could impact property values. Consider your daily commute, proximity to essential services, and access to recreational facilities that align with your lifestyle.

Drive through the neighborhood at different times of day and days of the week to get a true sense of traffic patterns, noise levels, and community dynamics. Pay attention to the condition of neighboring properties, as they directly influence your home’s future value. Research municipal services, including garbage collection, snow removal, and emergency services response times. Working with a knowledgeable expert, such as a real estate listing agent near Woodinville, Washington or your specific area can provide invaluable insights into local market conditions and neighborhood characteristics that might not be apparent to outsiders.

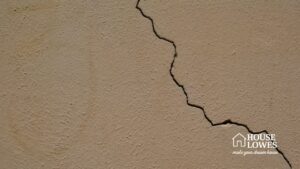

Property Condition and Structural Integrity

A thorough evaluation of the property’s physical condition is essential to avoid unexpected expenses after purchase. Start with the home’s structural elements, including the foundation, which should appear in good condition with no significant cracks. Examine the roof for missing or damaged shingles, proper flashing around chimneys and vents, and evidence of water damage or leaks.

Interior assessment should focus on the electrical system, ensuring it meets current safety codes and has sufficient capacity for modern appliances. Inspect the plumbing for adequate water pressure, proper drainage, and signs of leaks or corrosion. The heating, ventilation, and air conditioning systems require careful evaluation for efficiency, age, and maintenance history. Good drainage, including downspouts, away from the house with no standing water is crucial for preventing future foundation and moisture problems.

Safety Features and Code Compliance

Modern safety standards have evolved significantly, making it important to verify that any potential home includes essential safety features. The safety features that you should ensure are present in the house include fire and carbon monoxide detectors, emergency exits, and secure door locks. Check that smoke detectors are properly installed in bedrooms, hallways, and common areas, and verify that they’re hardwired rather than battery-operated when possible.

Evaluate the electrical panel for proper labeling, adequate capacity, and compliance with current codes. Ground Fault Circuit Interrupter outlets should be present in bathrooms, kitchens, and outdoor areas. Stairways should have sturdy handrails and adequate lighting, while windows should operate smoothly and include proper locking mechanisms.

Professional Home Inspection

While your personal assessment is valuable, hiring a qualified professional inspector is non-negotiable. After the home inspection, you receive a report that goes over the property’s major features and outlines any issues. Professional inspectors have specialized knowledge and tools to identify problems that might escape an untrained eye.

The inspection should cover all major systems and structural components, including areas that may be difficult to access such as crawl spaces, attics, and electrical panels. Major safety or functionality concerns should be assessed and addressed, including issues with electrical systems, plumbing leaks, HVAC failures, structural problems, or anything that could prevent a buyer from securing financing. Use the inspection report as a negotiating tool, requesting repairs or price adjustments for significant issues discovered during the process.

Future Considerations and Long-Term Value

Think beyond your immediate needs and consider how the property will serve you in the coming years. Evaluate the home’s potential for appreciation based on neighborhood trends, planned infrastructure improvements, and overall market conditions. The price per square foot is $216, increased from $213 in March 2024, indicating continued market growth in many areas.

Consider the property’s adaptability to changing life circumstances, such as family expansion, aging in place, or work-from-home requirements. Properties with flexible floor plans, adequate storage, and potential for modification often provide better long-term value. Research local zoning laws and homeowners association restrictions that might limit future renovations or improvements.

Final Word

Buying a new house requires careful consideration of multiple factors, from financial readiness and location assessment to structural integrity and future potential. With 69% of prospective homebuyers committed to purchasing a home based on their own timeline, irrespective of prices and interest rates, it’s clear that thorough preparation and informed decision-making are more important than perfect market timing. By systematically evaluating each aspect of a potential purchase, you can make a confident decision that will serve your needs for years to come. Remember that professional guidance from real estate agents, inspectors, and financial advisors can provide valuable expertise throughout this complex process, helping ensure your investment is both sound and satisfying.

Admin Recommendation

Durable & Stylish Bronze Metal Roof – Your Complete Guide